Not long ago, an acquaintance in the motorcycle business said that “Millennials are a bunch of coddled wimps and that’s why they don’t ride motorcycles. It’s too dangerous.” Of course, riding a motorcycle is insanely dangerous, but I see Millennials doing dangerous things all the time; on bicycles, skates and skateboards, skis, a variety of surfing toys, rocks and mountains, boats, and even motorcycles in the X-Games. I don’t think the danger is the issue. There is something else going on here.

Not long ago, an acquaintance in the motorcycle business said that “Millennials are a bunch of coddled wimps and that’s why they don’t ride motorcycles. It’s too dangerous.” Of course, riding a motorcycle is insanely dangerous, but I see Millennials doing dangerous things all the time; on bicycles, skates and skateboards, skis, a variety of surfing toys, rocks and mountains, boats, and even motorcycles in the X-Games. I don’t think the danger is the issue. There is something else going on here.

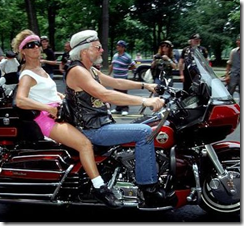

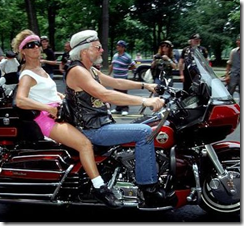

That is a good thing, too, because my generation has gone bananas. Between the idiocy of handing billionaires billion-dollar sports stadiums paid with taxpayers money and stupid crap like universities handing out football scholarships to 9-year-olds, it’s clear that the “adults” in our society need to grow up. Obviously, the whole Boomers and Bikers silliness was not a sign that my generation had a lick of sense. They parade their senility through towns like Red Wing as if they imagine nobody would ever think about laughing at their pirate outfits and godawful motorcycling skills. But they are very, very wrong. I’ve been hanging out with under-30 kids everywhere from Red Wing to downtown St. Paul to Pacific Coast Highway and they consistently think these folks and the activity/sport they represent are comedic, at best, and despicable on average. For the last thirty years, Boomers and the industry has done their best to make motorcycling look as ridiculous as possible. The reward for all that silliness is the current non-cool status of motorcycling. Add to it the fact that most small cars are more fuel and cost efficient that motorcycles and you have a perfect storm of obsolescence.

That is a good thing, too, because my generation has gone bananas. Between the idiocy of handing billionaires billion-dollar sports stadiums paid with taxpayers money and stupid crap like universities handing out football scholarships to 9-year-olds, it’s clear that the “adults” in our society need to grow up. Obviously, the whole Boomers and Bikers silliness was not a sign that my generation had a lick of sense. They parade their senility through towns like Red Wing as if they imagine nobody would ever think about laughing at their pirate outfits and godawful motorcycling skills. But they are very, very wrong. I’ve been hanging out with under-30 kids everywhere from Red Wing to downtown St. Paul to Pacific Coast Highway and they consistently think these folks and the activity/sport they represent are comedic, at best, and despicable on average. For the last thirty years, Boomers and the industry has done their best to make motorcycling look as ridiculous as possible. The reward for all that silliness is the current non-cool status of motorcycling. Add to it the fact that most small cars are more fuel and cost efficient that motorcycles and you have a perfect storm of obsolescence.

An interesting parallel is the music business, at one end electric guitar sales and at the other the old fashioned record labels and music distribution. The Washington Post published an article titled “The Death of the Electric Guitar” that explained a lot of the reasons why the electric guitar may be an old guy’s instrument. This story should sound familiar, Richard Ash, the CEO of Sam Ash, the largest chain of family-owned music stores in the country, said, “Our customers are getting older, and they’re going to be gone soon.” Or how about this fact, “Over the past three years, Gibson’s annual revenue has fallen from $2.1 billion to $1.7 billion, according to data gathered by Music Trades magazine. The company’s 2014 purchase of Philips’s audio division for $135 million led to debt — how much, the company won’t say — and a Moody’s downgrading last year. Fender, which had to abandon a public offering in 2012, has fallen from $675 million in revenue to $545 million. It has cut its debt in recent years, but it remains at $100 million.” Fender’s weird defense of its business model includes the odd statement, “Ukulele sales are exploding.” Ukes were a brief fad, but not a meaningful shift in popular music. Scooter sales were doing pretty well, for a while, but that didn’t mean much for the motorcycle industry, either.

At the label end of the music music industry, the business has been so deformed from the gatekeeper format of the previous century that “Gotye created his song ‘Somebody That I Used to Know’ in his parents' house near Melbourne, Australia. The self-produced track reached number one on more than 23 national charts and charted inside the top 10 in more than 30 countries around the world. By the end of 2012, the song became the best-selling song of that year with 11.8 million copies sold, ranking it among the best-selling digital singles of all time,” according to an Elite Daily article titled “How One Generation Was Single-Handedly Able to Kill the Music Industry.” Wimps don’t whip international corporations at their own game. These kids have totally changed the damn game. There has been some yip-yap about the music industry “recovery,” but that is a funny term for seven years of stable gross sales with dramatically changing income sources (see the chart above). Sales of physicial media are about a quarter of their 1999 peak while digital distribution, including direct sales, is growing exponentially.

At the label end of the music music industry, the business has been so deformed from the gatekeeper format of the previous century that “Gotye created his song ‘Somebody That I Used to Know’ in his parents' house near Melbourne, Australia. The self-produced track reached number one on more than 23 national charts and charted inside the top 10 in more than 30 countries around the world. By the end of 2012, the song became the best-selling song of that year with 11.8 million copies sold, ranking it among the best-selling digital singles of all time,” according to an Elite Daily article titled “How One Generation Was Single-Handedly Able to Kill the Music Industry.” Wimps don’t whip international corporations at their own game. These kids have totally changed the damn game. There has been some yip-yap about the music industry “recovery,” but that is a funny term for seven years of stable gross sales with dramatically changing income sources (see the chart above). Sales of physicial media are about a quarter of their 1999 peak while digital distribution, including direct sales, is growing exponentially.

How does all that relate to disappearing motorcycle sales and declining motorcycle use? I’m not sure, but I think there is a connection. The times and the tools are changin’. My grandson has repeatedly said he would get a motorcycle license before he’d be interested in a car. He would, also, rather have an electric motorcycle than a gas-burner. He’s not alone. Since electric motorcycles are barely making a dent in that market, electric bicycles have really stepped up and are crossing the line between bicycles, scooters, and motorcycles; filling every motorcycle niche from vintage to cafe racer to competitive sports with 50-100 mile ranges and 20-to-40-and more-mph top speeds. Like the early years of the motorcycle, there are dozens of electric bicycle brands and you can buy them everywhere from dedicted high-end botique stores like Pedago to low-end offerings from Walmart.

How does all that relate to disappearing motorcycle sales and declining motorcycle use? I’m not sure, but I think there is a connection. The times and the tools are changin’. My grandson has repeatedly said he would get a motorcycle license before he’d be interested in a car. He would, also, rather have an electric motorcycle than a gas-burner. He’s not alone. Since electric motorcycles are barely making a dent in that market, electric bicycles have really stepped up and are crossing the line between bicycles, scooters, and motorcycles; filling every motorcycle niche from vintage to cafe racer to competitive sports with 50-100 mile ranges and 20-to-40-and more-mph top speeds. Like the early years of the motorcycle, there are dozens of electric bicycle brands and you can buy them everywhere from dedicted high-end botique stores like Pedago to low-end offerings from Walmart.

The music business didn’t die. It moved to streaming media, movie and television soundtracks, and on-line digital purchases. Motorcycles won’t die out, but they will change radically. The brand names we recognize today may be as obscure in 20 years as Whippet, Stutz, Red Bug, Nash and Rambler and Nash-Rambler, Packer, and Oldsmobile. At one time there were thousands of auto manufacturers and there have been at least half that many motorcycle brands in the not-so-ancient history. As this electric vehicle revolution plays out, it’s going to be a survival of the fittest environment and there appears to be little evidence that the current brand names are in any way fit; especially the two prominent suck-squeeze-bang-blow US brands. With some luck, minimal incompetence from both Zero’s managment and the US government, and a few changes to motorcycling’s image and purpose, the US could still be a world player in the future market.

7 comments:

An interesting comparison of the motorcycle industry with the music industry. And I've met numerous 20-30 something that are really interested in electric motorcycles. Electric bicycles in this country still seems to be an expensive, exclusive niche. When I was last in Japan, electric assist bicycles were everywhere and you could pick one up at any department store. I haven't seen any in our local Walmart but then I never looked for one there either.

Walmart, Target, Sears, and lots of other places have 'em: https://www.walmart.com/tp/electric-bikes. My grandson's Radpower bike was about as expensive as a brake job on most cars and way more interesting and fun. You can, however, pay WAY too much for anything in the US and the top end of electric bicycles is just as nutty as the top end of any other toy in this country.

Hi Thomas,

There was an Italian company (now bankrupt - cash flow I think), that had a very neat solution to electric bikes. You can still read about it here, and hopefully it will be back in some form in the future. http://www.actaspa.com/hydrogen-in-transport-scooting-around-the-islands-cleantech-magazine/

Basically, you have a recharge station where you plug the bike in. It has a roof that collects rainwater, and which has photovoltaic cells that power a hydrogen electrolyser. This refills the bike's hydrogen fuel cells when parked. Free energy; a lovely neat solution. They were trailed in Hawaii. Enjoy.

Ian

Wow! I had no idea such a brilliant product existed. I should have, too. Hydrogen fuel cells is one of my favorite alternative energy sources and I've followed and invested in it for almost two decades.

One of my best pre-2001-tech-crash investments was a hydrogen power and fuel cell tech company, Ballard Power (BLDP). I got in early and got out late, so my investment was good, but not great. Through the Bush years, alternative energy stocks tanked and kept tanking until many, like Ballard, became junk stocks. I bought back into Ballard when it was selling for about $0.30/share (you read that right) and kept buying as the company moved to Canada, split off the automotive research division, and kept working on large energy solutions using fuel cells. The stock has peaked around $6 a few times in the last decade and is about $3.50 now, but I believe in the technology and I don't have a lot of initial investment in the company. I bought a few thousand shares at $0.30-0.45 and I'd rather lose that money than give up on alternative energy with a company that just keeps trying to do the right thing.

I hope I live long enough to see this kind of optimism and technical initiative make a comeback.

Hi Thomas,

I’m glad you liked the article. I too (as you have probably guessed by now), am a fan of the technology. A little research shows that Acta, now reborn as Enapter, supplied Ballard with electrolysers. They had some great products in the pipeline. For example, imagine welding with water! Split with an electrolyser into its constituents, and then weld with a hydrogen/ oxygen mix. Great stuff and I wanted one of those welders.

Getting the hydrogen economy going is a real global business. There is an application example on the Ballard site for hydrogen buses in London. Ballard make the cells, but the buses themselves are made by Wright Bus, here in Northern Ireland.

Ian

Cas,

I'm too lazy to hunt it down again, but several years ago I read an article about how France incorporated splitting hydrogen from oxygen as part of their nuclear power-plant operations. As a result, they had a large surplus of hydrogen to use on those hydrogen buses and other transportation applications. In the US, we are falling so far behind in practically every technological field, except mediocre social media programming, it's hard to imagine how the US will ever be a serious contributor or competitor again.

Post a Comment